On April 22, three O-Lab affiliated faculty presented some of their most recent research to a captivated audience.

Rucker Johnson, Associate Professor in the Goldman School of Public Policy and a Faculty Research Associate of the National Bureau of Economic Research discussed his research on the synergistic effects of pre-K and K-12 spending on children’s long-run adult attainments.

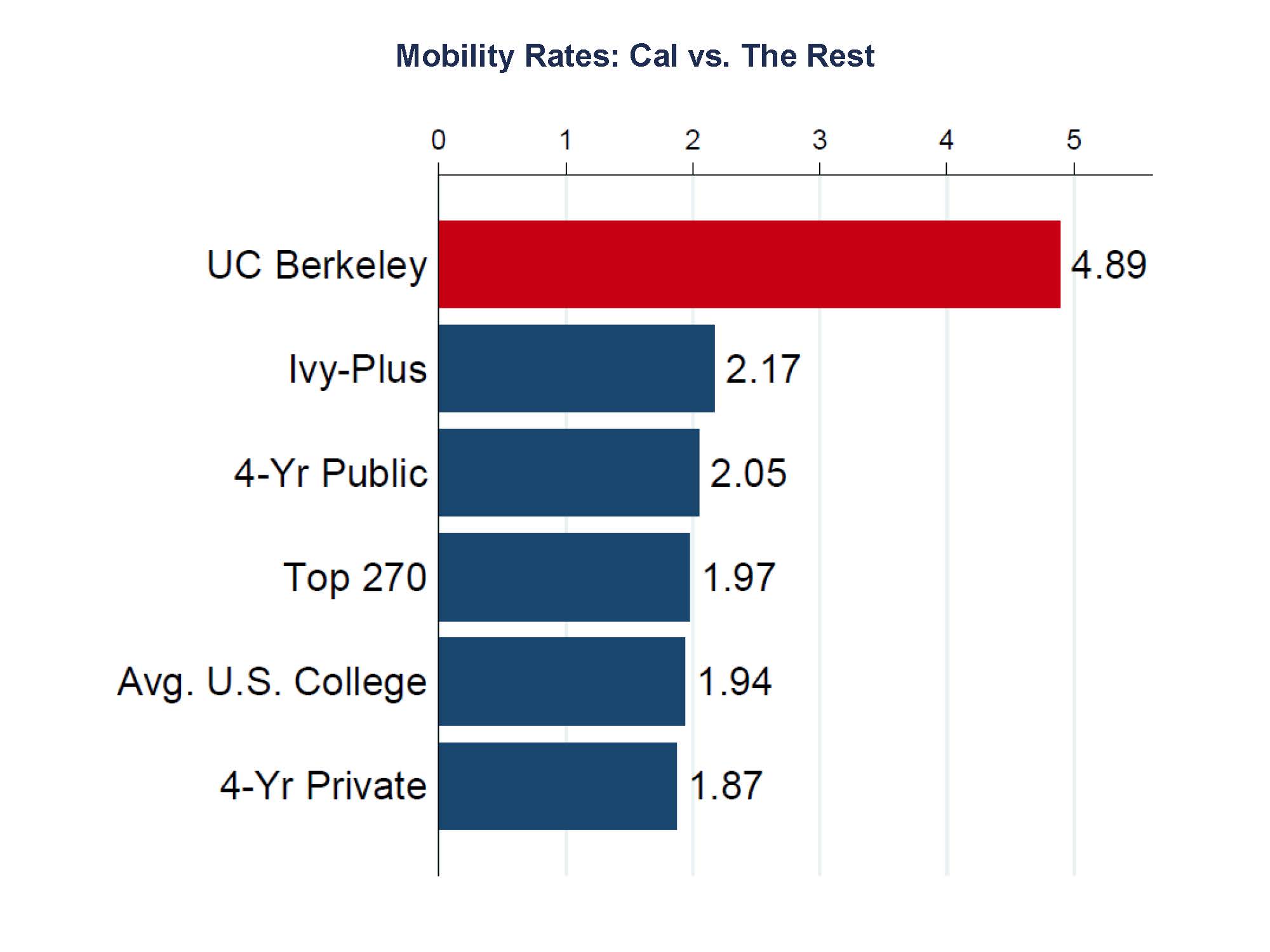

Danny Yagan, Assistant Professor of Economics and Faculty Lead of O-Lab’s Taxation and Inequality Initiative shared his Mobility Report Cards research, which shows that some colleges have a significant number of students who come from low-income families and end up as high-income adults.

Supreet Kaur, Assistant Professor of Economics, spoke about new advances in the psychology of poverty: how integrating ideas from psychology into economics can help us better understand why it is difficult for the poor to escape poverty. Kaur did this by describing empirical results from field experiments with manufacturing workers that indicate the experience of poverty itself lowers cognitive functioning and worker productivity.

Learn about upcoming events by following us on Twitter, @Berkeley_OLab or signing up for our newsletter by emailing info.olab@berkeley.edu