Taxation & Inequality Research

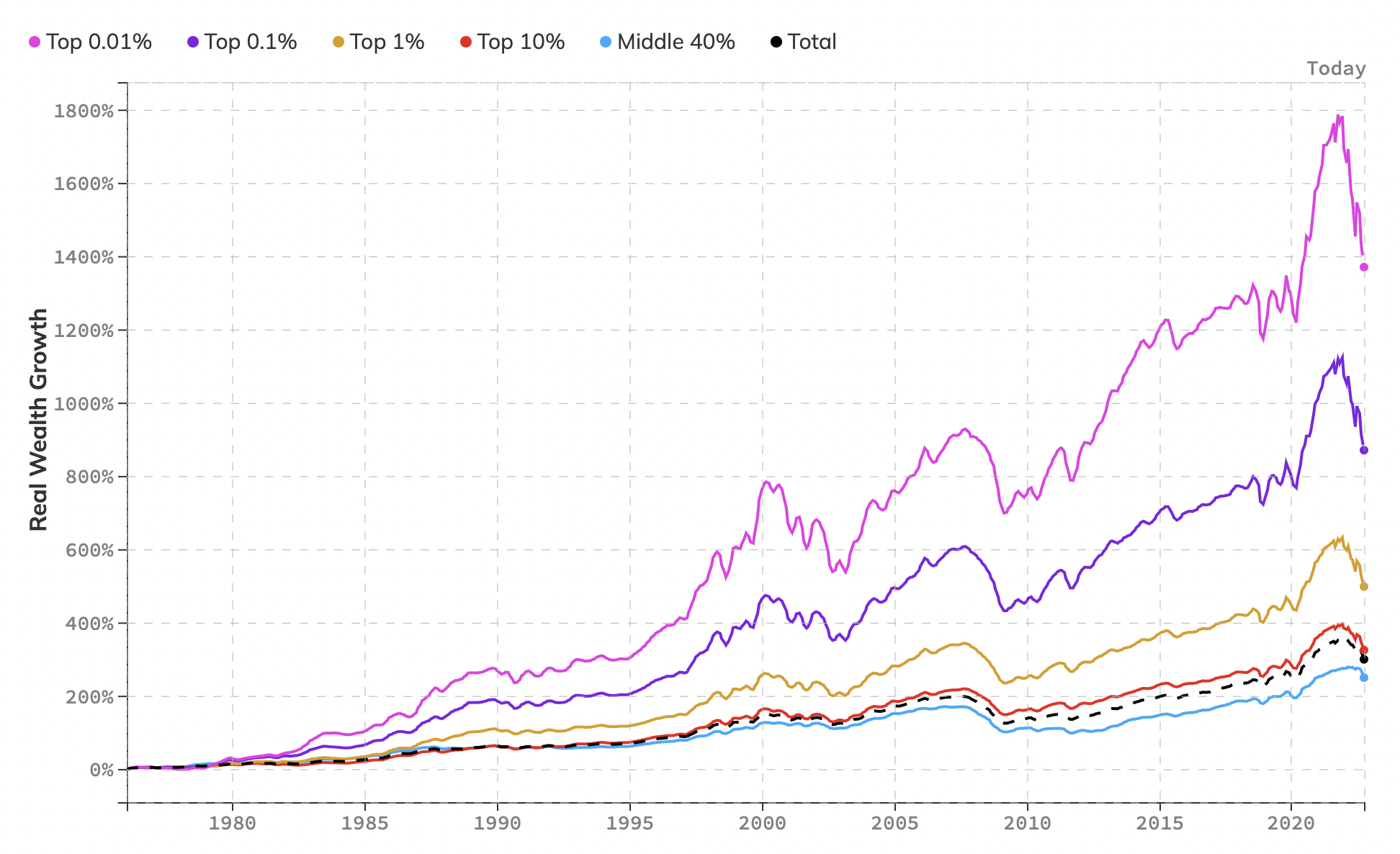

With economic inequality rising, the identification of policies which address equitable and efficient taxation is a defining challenge of our time. The Opportunity Lab's Taxation and Inequality Initiative, led by Professors Emmanuel Saez and Gabriel Zucman, conducts research on the causes and consequences of rising inequality and on policies which might mitigate this trend. Affiliated scholars act as leading voices in discussions on economic inequality, tax policy, and the interplay between the two. Publications include seminal work on long-run trends in economic inequality in the US and abroad, the functioning of the US tax system, the equity and efficiency effects of tax reforms, and the challenges raised by globalization in taxing income and wealth effectively.